If you have ever heard talk or been to a seminar about “sovereignty”, then very likely those conversations were influenced by the foundational research of the author and educator.

His research and educational journey reaching millions of people worldwide began in 1992 and culminated in 2022 with the 3-Volume book release – his final word on the subject.

At the turn of the millennium his books and audio courses facilitated in part – a sovereignty and tax-honesty movement that involved millions of Americans.

This 3 Volume series comprises the life’s work of Johnny Liberty filled with comprehensive insights into the last few hundred years of history, law, economics, money, citizenship and governance.

These books show how it is supposed to be done in a constitutional Republic.

How did We the People get to where we are today?

What can we do to reclaim our inherent sovereignty and natural rights?

Many of the answers may be found within these revolutionary pages. Available as a paperback, E-Book (PDF) or an Amazon Kindle format. Thank you for supporting the author.

Sincerely,

With Freedom For All,

~ Johnny Liberty

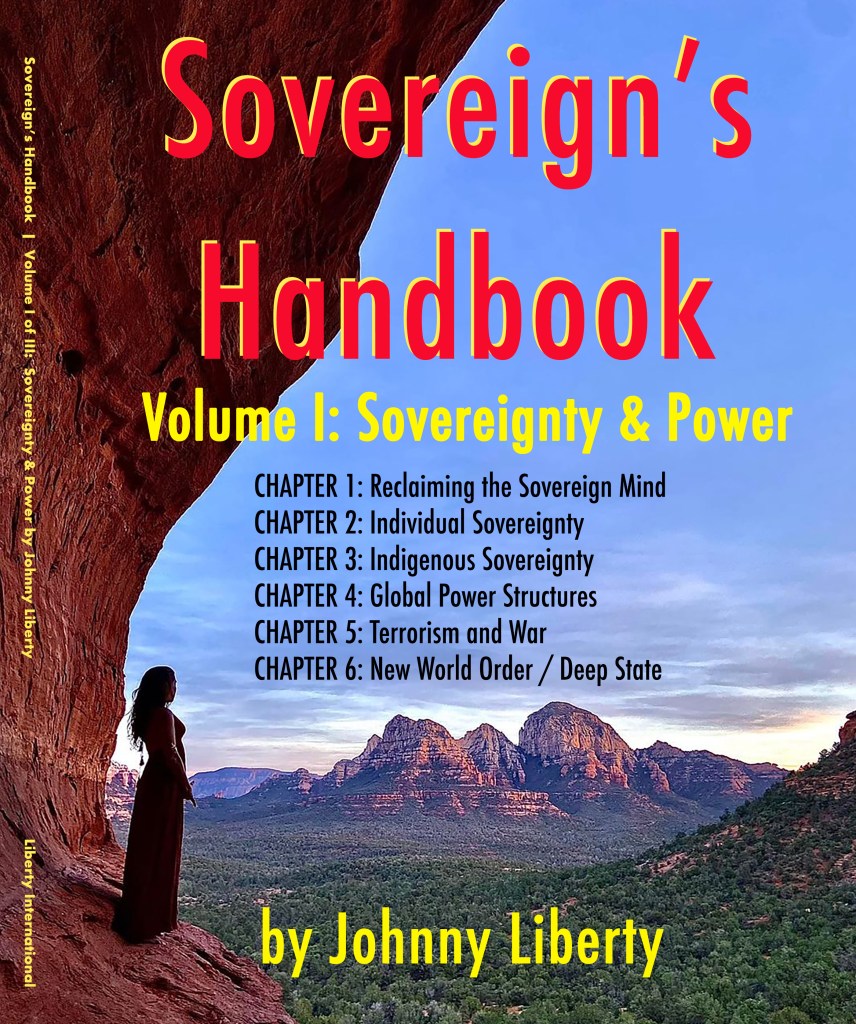

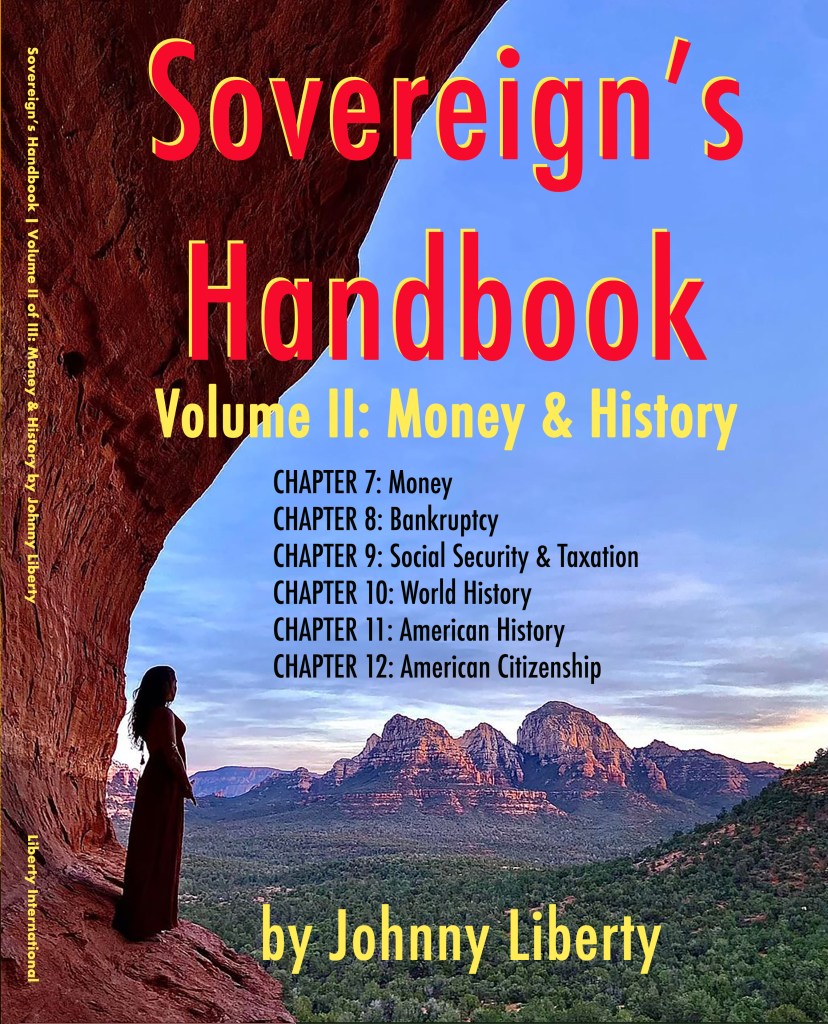

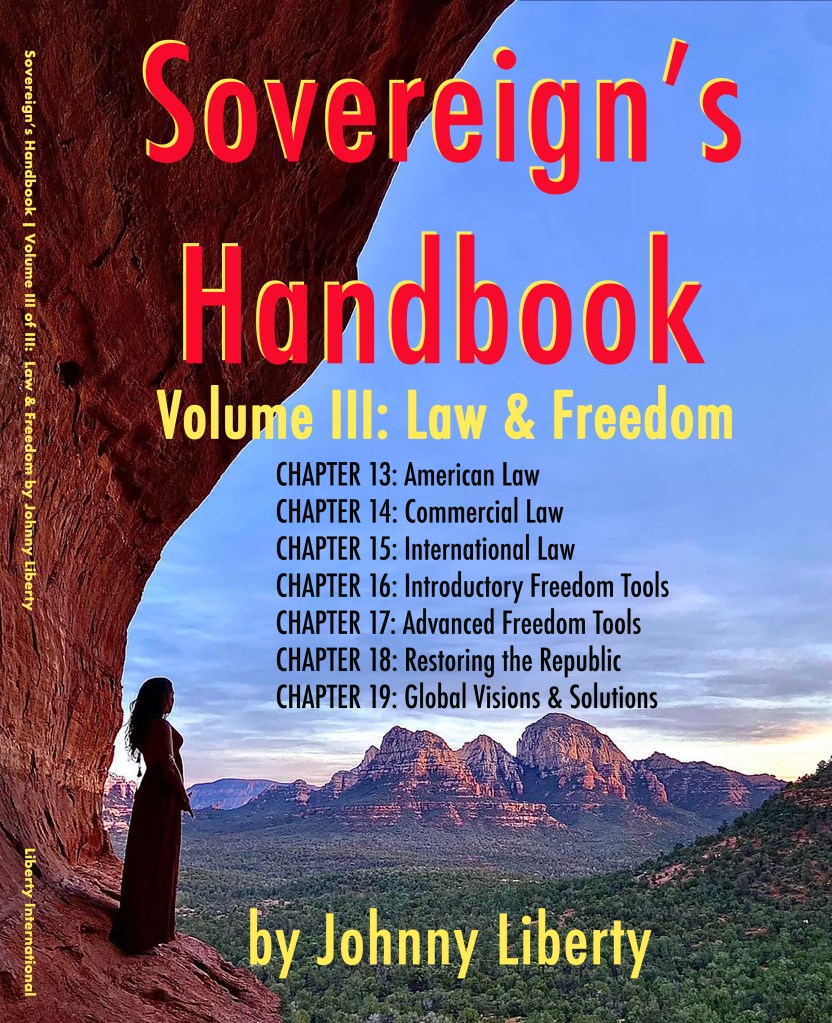

Sovereign’s Handbook by Johnny Liberty (30th Anniversary Edition)

- A three-volume, 750 page tome with an extensive update of the renowned underground classic ~ the Global Sovereign’s Handbook.

- Still after all these years, it is the most comprehensive book on sovereignty, economics, law, power structures and history ever written.

- Served as the primary research behind the best-selling Global One Audio Course.

- ORDER NOW!

- $99.99 ~ THREE VOLUME PRINT SERIES

- $33.33 ~ THREE VOLUME E-BOOK

The 3 Volume Sovereign’s Handbook by Johnny Liberty is textbook material for everyone including educators/teachers, homeschoolers, historians, activists, leaders/politicians, attorneys/judges/law schools, police officers, and state Citizens/Nationals.

Order Additional Books, Audios & Videos from The Freedom Catalog: LibertyInternationalBooks.com

Sovereign’s Handbook (Website): http://SovereignsHandbook.com

Dawning of the Corona Age (Website): DawningoftheCoronaAge.com

Liberty International News: http://LibertyInternational.news

ORDER YOUR LIBERTY BOOKS TODAY!

Sovereign’s Handbook by Johnny Liberty

(30th Anniversary Edition)

(3-Volume Printed, Bound Book or PDF)

A three-volume, 750+ page tome with an extensive update of the renowned underground classic ~ the Global Sovereign’s Handbook. Still after all these years, this is the most comprehensive book on sovereignty, economics, law, power structures and history ever written. Served as the primary research behind the best-selling Global One Audio Course. Available Now!

$99.95 ~ THREE-VOLUME PRINT SERIES

$33.33 ~ THREE-VOLUME EBOOK

Dawning of the Corona Age: Navigating the Pandemic by Johnny Freedom

(3rd Edition)

(Printed, Bound Book or PDF)

This comprehensive book, goes far beyond the immediate impact of the “pandemic”, but, along with the reader, imagines how our human world may be altered, both positively and negatively, long into an uncertain future. Available Now!

$25.00 ~ PRINT BOOK

$10.00 ~ EBOOK