By Nick Giambruno

It’s been rightly said that “he who holds the gold makes the rules.”

After World War 2, the US had the largest gold reserves in the world, by far. Along with winning the war, this let the US reconstruct the global monetary system around the dollar.

The new system, created at the Bretton Woods Conference in 1944, tied the currencies of virtually every country in the world to the US dollar through a fixed exchange rate. It also tied the US dollar to gold at a fixed rate of $35 per ounce.

The dollar was said to be “as good as gold.”

The Bretton Woods system made the US dollar the world’s premier reserve currency. It compelled other countries to store dollars for international trade or to exchange them with the US government for gold at the promised price.

However, it was doomed to fail.

Runaway spending on warfare and welfare caused the US government to print more dollars than it could back with gold at the promised price.

By 1967, the number of dollars circulating had drastically increased relative to the amount of gold backing them. This encouraged foreign countries to exchange their dollars for gold, draining the US gold supply at an alarming rate and collapsing the London Gold Pool. At this point, it was clear this system was breaking down.

On Sunday night, August 15, 1971, President Nixon interrupted the scheduled TV programs and made a surprise announcement to the nation—and the world. He announced the unilateral end of the Bretton Woods system and severed the dollar’s last tie to gold.

The end of the dollar’s gold backing had profound geopolitical consequences.

Most critically, it eliminated the main reason foreign countries stored large amounts of US dollars and used the US dollar for international trade. As a result, oil-producing countries began to demand payment in gold instead of rapidly depreciating dollars.

It was clear the US would have to create a new monetary system to stabilize the dollar. So it concocted a new scheme… and chose Saudi Arabia as its accomplice. This agreement came to be known as the “petrodollar system.”

The US handpicked Saudi Arabia because of its vast petroleum reserves and dominant position in the global oil market.

In essence, the petrodollar system was an agreement that the US would guarantee the House of Saud’s survival. In exchange, Saudi Arabia would do three things.

First, it would use its dominant position in OPEC to ensure that all oil transactions would only happen in US dollars.

Second, it would recycle hundreds of billions of US dollars from annual oil revenue into US Treasuries. This lets the US issue more debt and finance previously unimaginable budget deficits.

Third, it would guarantee the price of oil within limits acceptable to the US and prevent another oil embargo.

The petrodollar system gave foreign countries another compelling reason to hold and use the dollar. And it preserved the dollar’s unique status as the world’s top reserve currency.

But… why oil?

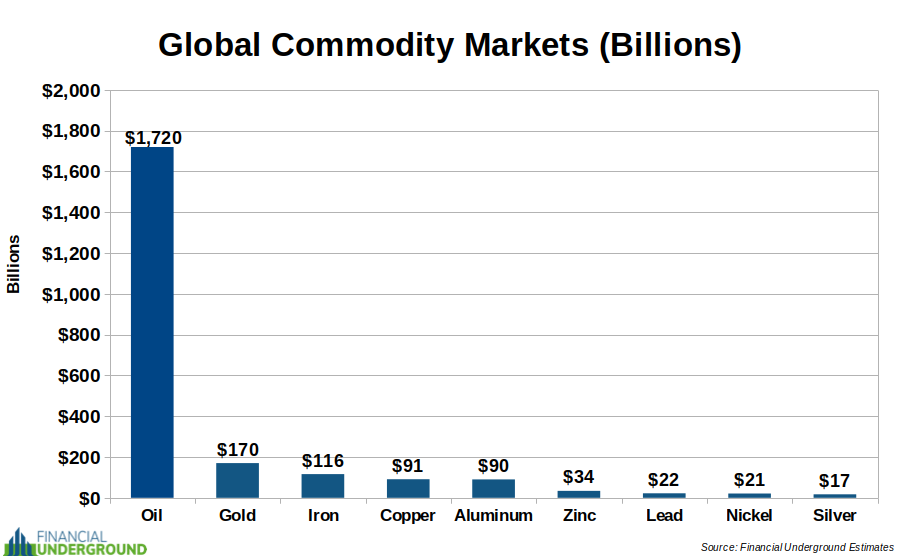

Oil is the largest and most strategic commodity market in the world.

As you can see in the chart below, it dwarfs all other major commodity markets combined. The annual production value of the oil market is ten times bigger than the gold market, for example.

Every country needs oil. And if foreign countries need US dollars to buy oil, they have a compelling reason to hold US dollars even if they are not backed by a promise to redeem them in gold.

Think about it… If France wants to buy oil from Saudi Arabia, it must purchase US dollars on the foreign exchange market to pay for the oil first.

This creates a huge artificial market for US dollars and differentiates the US dollar from a purely local currency, like the Mexican peso.

The dollar is just a middleman. It’s used in countless transactions, amounting to trillions of dollars that have nothing to do with US products or services.

Since the oil market is enormous, it acts as a benchmark for international trade. If foreign countries are already using dollars for oil, it’s easier to use the dollar for other international trade.

In addition to nearly all oil sales, the US dollar is used for about 80% of all international transactions.

Ultimately, the petrodollar boosts the US dollar’s purchasing power by enticing foreigners to soak up dollars.

The petrodollar system has helped create a deeper, more liquid market for the dollar and US Treasuries. It has also helped the US keep interest rates lower than they would otherwise be, allowing the US government to finance enormous deficits it otherwise would be unable to.

Multi-trillion deficits would otherwise be impossible without destroying the currency through money printing.

It’s hard to overstate how much the petrodollar system benefits the US. It’s the bedrock of the US financial system and has underpinned the dollar’s role as the world’s reserve currency since the 1970s.

That’s why the US government protects it so fiercely. It needs the system to survive.

World leaders who have challenged the petrodollar have ended up dead.

Take Saddam Hussein and Muammar Gaddafi, for example. Each led a large oil-producing country—Iraq and Libya, respectively. And both tried to sell their oil for something other than US dollars before US military interventions led to their deaths.

Of course, there were other reasons the US toppled Saddam and Gaddafi. But protecting the petrodollar was a serious consideration, at the very least.

When countries like Iraq and Libya challenge the petrodollar system, it’s one thing. The US military can dispatch them with ease.

However, it’s a whole other dynamic when China (and Russia) undermine the petrodollar system… which is happening in a big way right now.

China and Russia are the only countries with sophisticated enough nuclear arsenals to go toe-to-toe with the US up to the top of the military escalation ladder.

In other words, the US military can’t attack Russia and China with impunity because they can match each move up to all-out nuclear war—the very top of the military escalation ladder.

For this reason, the US is deterred from entering a direct military conflict with China and Russia—even though they are about to strike a fatal blow to the petrodollar system.

US Sanctions Accelerate Demise of Petrodollar

In the wake of Russia’s invasion of Ukraine, the US government launched its most aggressive sanctions campaign ever.

Exceeding even Iran and North Korea, Russia is now the most sanctioned nation in the world.

“This is financial nuclear war and the largest sanctions event in history,” said a former US Treasury Department official.

He said, “Russia went from being part of the global economy to the single largest target of global sanctions and a financial pariah in less than two weeks.”

As part of this, the US government seized the US dollar reserves of the Russian central bank—the accumulated savings of the nation. (Washington did the same to Afghanistan’s dollar reserves after the Taliban took Kabul.)

It was a stunning illustration of the dollar’s political risk. The US government can seize another sovereign country’s dollar reserves at the flip of a switch.

The Wall Street Journal, in an article titled “If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock,” noted:

“Sanctions have shown that currency reserves accumulated by central banks can be taken away. With China taking note, this may reshape geopolitics, economic management and even the international role of the U.S. dollar.”

The head of the Russian Parliament recently called the US dollar a “candy wrapper” but not the candy itself. In other words, the dollar has the outward appearance of money but is not real money.

It’s important to remember some simple facts.

#1: Russia is the world’s largest energy producer.

#2: China is the world’s largest energy importer.

#3: Russia is China’s largest oil supplier.

And now that the US has banned Russia from the dollar system, there is an urgent need for a credible system capable of handling hundreds of billions worth of oil sales outside the US dollar and financial system.

The Shanghai International Energy Exchange (INE) is that system. The maturation of China’s alternative to the petrodollar is a big reason why the massive amount of energy trade between Russia and China occurs in yuan, not US dollars.

Further, Washington has threatened to sanction China similarly for years.

These threats against China may be a bluff, but if the US government carried them out—as it recently did against Russia—it would be like dropping a financial nuclear bomb on Beijing. Without access to dollars, China would have previously struggled to import oil and engage in international trade. As a result, its economy would come to a grinding halt, an intolerable threat to the stability of the Chinese government.

China would rather not depend on an adversary like this. It’s one of the main reasons it created an alternative to the petrodollar system. The INE allows oil producers to sell their products for yuan (and gold indirectly) while bypassing the US dollar, sanctions, and financial system.

Other countries on Washington’s sanctions list are enthusiastically signing up.

According to Credit Suisse, Russia, Iran, and Venezuela own 40% of the proven oil reserves of OPEC+ members. These countries are under strict US sanctions, which makes accepting US dollars and transacting globally challenging. So it’s no surprise that these sanctioned oil producers are happy to accept yuan as payment and support the petroyuan system.

But it’s not just sanctioned oil producers that benefit from the petroyuan…

Think about it. Any oil-producing country has two choices:

Option #1 – The Petrodollar

The dismal financial situation of the US guarantees the dollar will lose significant purchasing power.

Plus, there’s enormous political risk. Oil producers are exposed to the whims of the US government, which can confiscate their money whenever it wants, as it recently did to Russia.

Option #2 – Shanghai International Energy Exchange

Here, an oil producer can participate in the world’s largest market and try to capture more market share.

It can also easily convert and repatriate its proceeds into physical gold, an international form of money with no political or counterparty risk.

From the perspective of an oil producer, the choice is a no-brainer.

Even though most people have not realized it yet, we are at the end of the petrodollar system and on the cusp of a new monetary era.

There’s an excellent chance more financial turmoil is coming soon.

Are you ready for it?

Source: International Man